There is a lot of material about the not-so-nice VCs who take advantage of young and inexperienced founders. But the reverse also happens, founders that try to get money out of VCs for projects that have zero chance of every coming to fruit. Or worse still, founders that pretend to have something on the go when they really don’t and are just looking for the cash to make a run for it. The Modular Company, the merry band of friends that I founded and that does technical due diligence has about 25 customers, mostly VC and PE companies. The partners of these companies are bombarded with decks from parties looking for investment and these decks vary greatly in both quality and degree of seriousness.

Every once in a while something pops up that is extraordinary, the deck below is one of those. The deck is included here in its entirety, nothing has been redacted, the only thing I changed was to reduce the images in size to save a bit on bandwidth and to make the page load faster. The analysis column on the right hand side is mine, the deck itself has an interesting origin, and it seems as though variations on this scam have been around for a while but this is the first sample of such a deck that I got my hands on.

Please note: The deck below is an outright scam, do not believe a word of what you read, do not believe that people mentioned in it exist or are aware of the fact that their name is used in this way (though they may very well be, there is no way for me to be sure). I obtained this deck without NDA and so I’m free to share it with the world as an example of what a scam can look like, even though the author has copyright on the contents, I think the gravity of this Public Service Announcement far outweighs the rightsholders claim. Note that the resources referenced in this post suffer from bitrot in a way that not much else on the web does, and that the players have every incentive to cleanse their reputation so if you read this long after it was posted the chances are that external links and search results referenced here will no longer work. If you want to enlarge a slide just click on it.

| The first thing you notice about this deck is that most of the slides look *really* good. A lot of work went into the presentation, the color scheme seems to have been lifted from the first Heroku iteration. The word 'Blockchain' on the opening slide is a bit of a tell, quite a few blockchain related start-up ideas have been floated in the last couple of years that were to use a charitable term 'less than stellar' and so DD professionals the world over will react with immediate suspicion upon encountering the term. Blockchain, like AI and many other terms that have come and gone over the years are investor bait, terms that are used to be able to lift along on a hype. |

| Can't argue with that. An important part of a good scam is apparently that you need to dress is up in such a way that *most* of it makes sense. That way a casual observer will see a lot of stuff that makes sense, and this feeling of things making sense then sets them up for when things make much less sense. They will interpret that then as feeling that maybe they simply do not understand, rather than that what they read is nonsense. |

| A bit more filler material. Like the previous slide, this one serves to set the reader up. A nice little detail for this slide is that relative to the scale of the Fiat economy the Bitcoin economy is vanishingly small but presented in this way it looks as though it is actually pretty much all of the world economy and the new player on the block. |

| This is an interesting slide. It makes a number of strong falsifiable claims. Let's look at them one by one: Bitcoin has outperformed any company in terms of ROI. ROI is typically presented as relative investment returns over time. Say you invest $10. Then after a while you divest and you find that your investment is now worth $20. Your ROI is 100%. Bitcoin outperforming 'any company' in terms of ROI is only true if you bought or mined your bitcoins early enough. If you bought your bitcoins just prior to the 2018 crash you would show a whopping 75% or more reduction in value. So while true for some people the reverse of this statement is also true for lots of people. Of course, the hype was promoted for years and the crash happened in a very short period of time. Since then Bitcoin has slowly regained some of its value but it is still trading substantially below the peak value of $19,891 in December 2017. The next statement is also interesting: "Cryptocurrencies and stablecoins are adopted by nation states and banks like Goldman Sachs." Banks 'like' Goldman Sachs, but not GS itself, they shelved their crypto plans, but JP Morgan rolled out their own. As for countries adopting cryptocurrencies, yes, there are some that did. But so what? It's just a name dropping and appeal to authority play. Even if banks and nationstates do adopt crypto currencies it doesn't really say anything positive *or* negative about the proposition in front of you. It's all still part of the setup. The second paragraph is also quite interesting, it is a neat trick that is being played on the reader here. *Of course* you are smart and already know that cryptocurrencies' value for the most part is based on speculation and nothing else. So that's why you should keep on reading, because the writers are transparent about this important fact and so build trust with the reader, and set the reader up to expect a crypto currency that *does* have a real use case and whose value is not based solely on speculation. |

| VC Buzzword bingo slide 5. TeMPOraL on HN writes: "I think the point of the graph is to just reinforce the mood. Be an emotional influence that makes you take the slide's message more seriously. Where the text talks about the reasons why other tokens fail, you see a line representing something going down in value fast. For some reason, just looking at it makes me feel sad, the "oh no my investments" kind sad. Which I believe was the whole goal.", which is likely spot on. |

| Fortunately, you're about to be rescued. Now we enter the 'pay-off' phase of the exercise. |

| Predictably, all those terrible things that happen to all other currencies will not happen this one, it is different, better believe it. Lots of buzzwords and alert terms here: 'uniquely', 'mass integration', 'opportunity', 'invest', 'safe'. All clearly meant to get the blood of investors looking for a quick buck to warm up. Of course, you, gentle reader have now brought out your wallet and are in the 'shut up and take my money' phase already. Or maybe not yet, and you need more convincing.|

| If you still need more convincing, then there is a lot of material here to do just that. We'll take it slow, because you're apparently a little bit dense, but don't worry, it happens. Two trigger terms on this page: 'proprietary', one of those words that investors apparently love. Usually this refers to some unique piece of IP which protects the company from having its hard work copied. The second one is more subtle, 'Qapital', because this is new, and there is no word yet for what we do, so you take a regular word and mis-spel it on purpose to set your stuff apart from the rest. |

| So it's a payment system. And a currency exchange. Both of these are heavily regulated, especially if you hold balances. It's also an investment platform. This starts to look like the company is trying to solve too many things at once, each of these would be a formidable challenge (witness 'Stripe'), and this is even bigger. Of course, an investor might think 'wow, this will be even bigger than Stripe' (unlikely, to put it mildly). |

| And lets throw in a whole investment vehicle a-la Y-Combinator in for good measure, in case you weren't interested yet. |

| For my next trick, I'll need a gullible member from the audience. After all you've read before you'd think we would get to the numbers pages now (these decks follow a predictable pattern). But no, there is even more! Throw in an Uber clone ('MyChauffeur') and an influencer platorm ("Chirpley"). Each of these deserves its own little mini deck. If you feel like going through these feel free, or, skip to slide 25, where we get down to brass tacks. |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

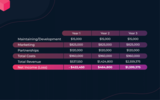

| So, this start-up that is at this point in time no more than a deck and a website wants to raise $30M. |

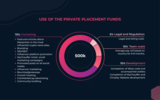

| The influencer platform will be built with $1M in annual expenses, the Uber clone will be built with $5M annual. And some pocket money to keep the lights on and some reserve in case a golden opportunity comes by. Note that at this point you've seen the equivalent of several *major* startups, without a word about the track record of the team, lots of buzzwords and copies of success stories by others. None of this has given you any confidence that the people involved can actually pull *any* of this off, let alone several such projects at the same time.|

| |

| There is no time to waste to get this show on the road, here is how it will be done, but not who will do it, where it will be done, whether they are actually already underway or any other details that might just tire an investor. FOMO, or 'Fear Of Missing Out' is the friend of legit start-up founders and scammers as well. |

| And there it is, the team page. Job ter Horst, CEO (A Job Terhorst actually exists, no idea if it is the same person or if he is aware his name and / or picture are used in this deck). The COO is cryptically named 'Sam'. It is fairly normal in decks such as these to refer to people by their full name, in fact I've never seen a deck that just gave the first name for a C-level exec, the Escobar look doesn't help either, but you can't really fault someone for how they look. The Head of Legal is called Richard. Rarely - no, sorry, - never have I seen a start-up that doesn't even exist yet that had a 'Head of legal'. You might have some legal company represent you for such things as incorporation, shareholder agreements and so on. But a head of legal for a company with 4 people and nobody else to be head of is a bit strange. Again, this legal eagle has no surname, a bit of sleuthing later and he *does* have a surname: Richard Nacht in the United States. And finally a man called David Freuden, assuming he exists. In a cheap pun on his name, I'm not sure if he is happy and aware that his image (if it is his image) and name are used in this deck. |

|

The https://warpchain.io/ website is up and running, maybe that will give us some more information about this exciting opportunity. So we navigate there and have a look at their pages. Again, the same slick basic website. But when you get to the team photographs the Head of Legal seems to have vanished. And Sam now has a name: Sam Chester. That’s good, we can feed that into google. A link to Seelz.net pops up as the first result on Google. Unfortunately, the server is down, but Google has the result page cached. Let’s read up a bit on the founders:

Sam ChesterBitcoin Finance Expert

sam

Areas of expertise

BitCoin and ICO Research & Development

Competitive advantage

The Ethereum Platforme

Turnaround Consulting

Is your business ready for a blockchain?

Education

MBA, Rotterdam School of Management, Erasmus University

BS, engineering, Technical University of Denmark

MBA, Rotterdam School of Management, Erasmus University

With over 20 years of experience in entrepreneurship, management,

business planning, financial analysis, software engineering,

operations, and decision analysis, Brandon has the breadth

and depth of experience needed to quickly understand entrepreneurs’

businesses and craft the most suitable solutions.

Blockchain WP comes up with results that are actually implementable.

That is their strength compared to other consulting companies.

Before founding Blockchain WP in early 2001, Brandon started two

Internet companies in Silicon Valley. Previously, Brandon held

various management positions in New York at Simon Brothers,

most recently as Vice President in Goldhill Group, focusing on

new business development and risk management. He has also worked

as a senior financial risk management consultant to the financial

services industry; software engineer; advertising sales manager

for the popular Caribbean travel guide series; general manager

of an advertising and graphic design agency; and engineering

intern at the Best Health Coach.

Wow, that’s quite a track record, you can’t make that up. Scratch that, maybe you actually can, and someone actually did. Also, amazing educational background. Management in NL, (twice!) and Engineering in Denmark. But what does ‘Brandon’ have to do with any of this, and what is this ‘Blockchain WP’?

Also interesting is how many other people have exactly that same combination of educational background: Anselm Hannemann/Peter Stumbles (that page is full of gems), Marko Dugonjić/Peter Stumbles (coincidentially, same phone number!),Clark Roberts (note how Clark Roberts does not appear on the team page itself, just on his own profile page), Veerle Pieters (who changes names and gender several times on the same page, and last (but not least) A lady called Mary Spencer, only she went three times to Rotterdam and twice to Denmark. What are the chances of this being coincicdence?

It appears that these sites have been compromised and the pages have been added surreptiously giving credence to the profiles linked. See, it’s not always that hackers want to have your data, sometimes your company can - unbeknownst to you - become part of an investor con.

The longer you dig, the more you will find with decks like these. The networks of content and people (real or faked) are vast. Decks such as these as well as the content pages on the websites can be made using stock photographs and templates. All you need to do is fill in the blanks and another scam is born. What I find surprising is how little effort has gone into creating a credible backstory for all this, even the most casual review of the data presented immediately leads to a ton of red flags and issues. Maybe this strategy is similar to how the Nigerian scammers work: put some obvious errors in the text, anybody that misses those is probably well worth the time invested and those that cancel early would have cancelled anyway, an optimization strategy.

Whatever your takeaway from this is, remember at least this: if you are an informal or angel investor, or even a VC that is not tech savvy or able to do research on the subjects of your prospective investments then there is a non-zero chance that someone will simply try to exploit that. Confer with your colleague investors, assume that if it looks too good to be true that it probably is, and that the other side is willing to invest a lot of time and effort into looking credible, they assume that you will do no background checks at all. If someone claims certain credentials, verify them. If they do business with certain parties check if they really do. If they don’t have lastnames, an online presence that is easily verified and they’re over 20 years old then there is probably something fishy going on. Honest mistakes of course do happen, but not at this level and when trying to pick up this much in funding.

Thanks to Jeff Laughton for corrections to the text.